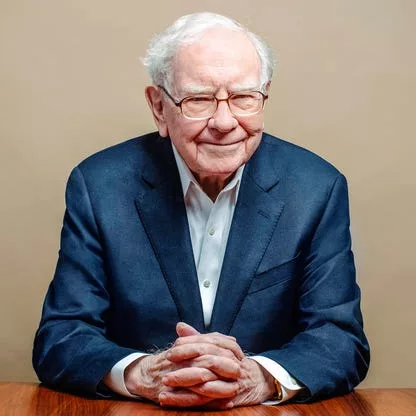

One of the wealthiest and most well-known investors in the world, Warren Buffett is referred to as the “Oracle of Omaha.” He is also an expert on investments. Buffett is the head of Berkshire Hathaway, which controls dozens of businesses, including the food chain Dairy Queen, the battery manufacturer Duracell, and the insurance Geico. He initially purchased shares at age 11 and first filed taxes at age 13, both as the son of a U.S. congressman.

“It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price” – Warren Buffett.

Investment Philosophy & Strategy

Buffett adheres to the Benjamin Graham school of value investing, which seeks out stocks with unreasonably low prices relative to their underlying value. Buffett examines businesses as a whole rather than concentrating on the intricate supply and demand dynamics of the stock market. He has long maintained the opinion that consumers should only purchase stocks in companies that display excellent fundamentals, significant earnings power, and the possibility for future growth. Buffett is a fervent supporter of the value-based investing philosophy.

Investment Methodology

Buffett benefits from the power of compound interest, dividend reinvestment, and the ability to continuously reinvest the operating cash flow produced by Berkshire’s businesses. How effective is this? Since Buffett took over in 1964, Berkshire has generated an annualized return of 20.1% on average, vs 10.5% for the S&P 500.

Top Holding

Buffett’s five largest holdings, making up more than half of the stock portfolio (AXP, Financial).

- Apple Inc. (AAPL, Financial)

- Bank of AmericaBAC -0.9% Corp. (BAC, Financial)

- Chevron Corp. (CVXCVX +1.9%, Financial)

- Coca-ColaKO -0.7% Co. (KO, Financial)

- American ExpressAXP -1.2% Co