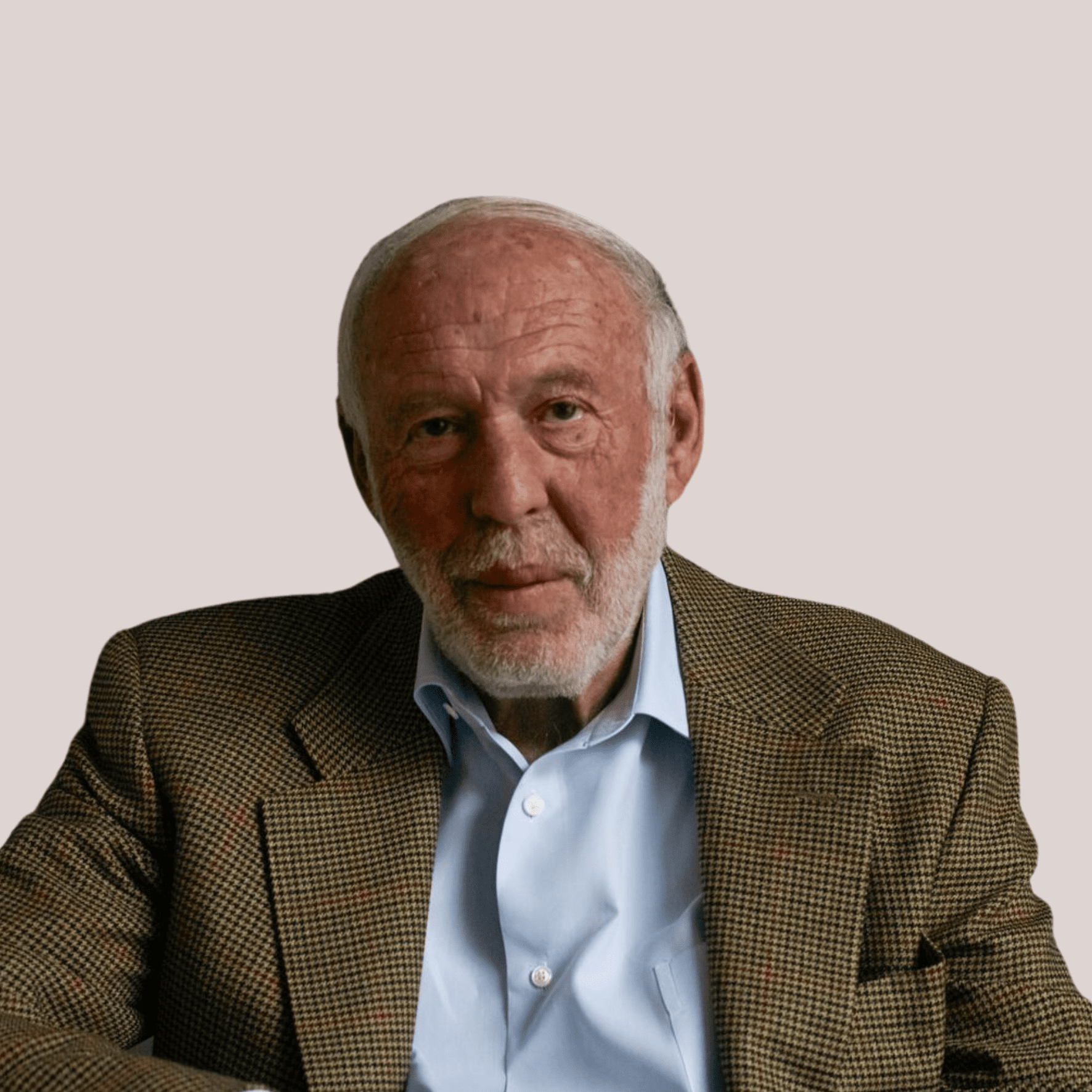

Jim Simons, a prominent mathematician and investor who this year ranked 48th on Forbes’ list of U.S. billionaires, with a net worth of $29 billion. His success has been critical in Wall Street’s shift to systematic models and an algorithmic approach, with almost all transactions now processed in this manner.

Investment Philosophy & Strategy:

As a prominent mathematician and investor, Simons’ strategies can be found in the success of his firm Renaissance Technologies and its Medallion Fund. Simons’ investment strategy is based on identifying and locating market patterns, which are movements that repeat over time and become predictable. Once identified, their dependability is evaluated using algorithms in so-called back testing. By 1982, he had established Renaissance Technologies, a prestigious quantitative trading hedge fund firm that manages approximately $55 billion.

1988, Renaissance established its most profitable fund Renaissance is well-known for its Medallion Fund, a $10 billion black box strategy available only to company owners and employees. From 2001 through 2013, the fund’s worst year was a 21 per cent gain, after subtracting fees. Medallion reaped a 98.2 per cent gain in 2008, the year the Standard & Poor’s 500 Index lost 38.5 per cent.

The magic behind Jim Simons’ trading strategies consists of collecting an enormous amount of data and analyzing the data to find statistical patterns and non-random events in a wide range of markets. Furthermore, Jim Simons and Renaissance Technologies have managed to put together a hard-working and secretive team that generates plenty of testable strategies. The employees have skin in the game, and unfortunately for us outsiders, few of Medallion’s strategies end up outside their offices.

Investment Methodology:

Simons founded the Monemetrics hedge fund in 1978, which allowed him to realize that pattern recognition could be applied to financial market trading, and he incorporated quantitative analysis into his investment strategy. As a result, he is known as the “Quant King “. Quantitative trading (also known as quant trading) employs computer algorithms and programs based on simple or complex mathematical models to identify and capitalize on available trading opportunities. Quants develop algorithms based on real-time data such as prices and quotes. The term “quant trader” refers to traders who perform quantitative analysis and other related activities.

Top Holdings

- NVO Novo-nordisk A-s

- MSFT Microsoft Corp

- ABNB Airbnb Inc

- HSY Hershey Co

- AMD Advanced Micro Devices Inc

- VRTX Vertex Pharmaceuticals Inc

- GILD Gilead Sciences Inc

- VRSN Verisign Inc

- ZM Zoom Video Communications Inc

- KR Kroger Co