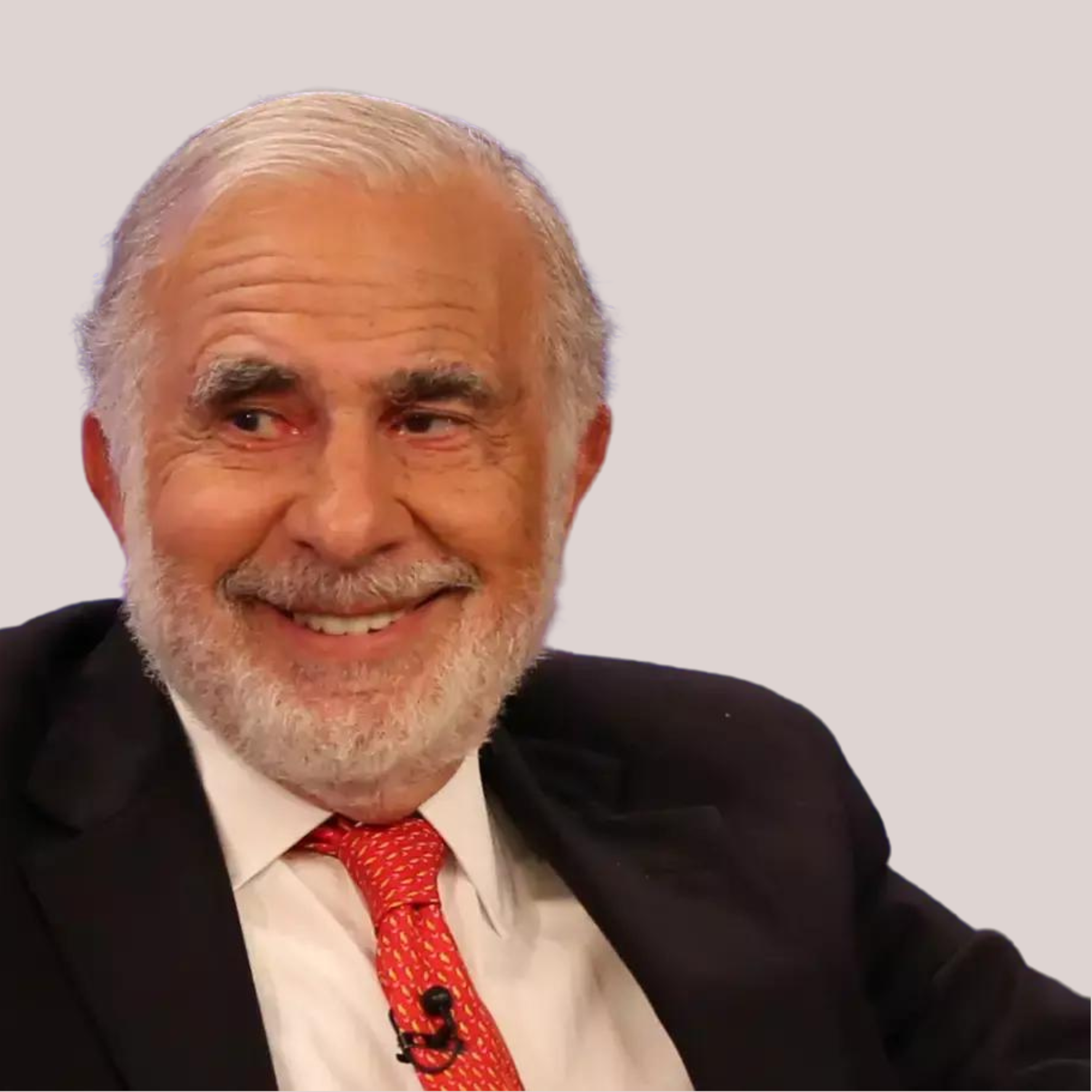

One of the most successful people on Wall Street is Carl Icahn. Using Drexel Burnham’s junk bonds, this corporate thief rose to the status of vulture capitalist in the 1980s. He invested in publicly traded firms and at first demanded radical changes in their corporate leadership and management methods. He was frequently the victim of “greenmail” payments from targets on the condition that he leave them alone.

His reputation transformed by the turn of the 20th century as a shareholder activist. Investors bought into the companies he focused on after following his lead. The “Icahn lift” refers to the increase in stock price brought on by the belief that Icahn would uncover shareholder value.

Investment Philosophy & Strategy:

Icahn follows a value investment philosophy, much like fellow billionaire investor Warren Buffett. In general, Icahn is drawn to stocks that don’t completely capture the potential of the companies. According to Icahn, he invests in a business when “no one wants it.”

Notably, this technique necessitates that a stock purchase is considered an investment in a company. So a follower of Icahn’s approach should be conversant with how the company runs before buying a stock. Icahn is interested in learning about aspects of a business that many people frequently overlook as the market and analysts are concentrated on quarterly, yearly, and stock price projections. This is an example of a contrarian investment strategy.

Investment Methodology:

Icahn’s experience with TWA would influence him to prioritize raising the share price of his companies by compelling the sale of the undervalued assets of the business. Greenmail payments made directly to Icahn could have been an alternative consequence.

Typically, Icahn would purchase a sizable chunk of the company’s stock and then put forth his own slate of candidates for election to the board of directors at the annual meeting.

This strategy was employed by Icahn to compel USX, the corporate offspring of Andrew Carnegie’s U.S. Steel, to separate its steelmaking businesses and concentrate on the petroleum industry through Marathon Oil. Both share classes increased by 28% in 1991 after a second class of USX shares was created to reflect the steel industry.

Top Holdings:

- (NASDAQ:IEP),

- Sandridge Energy (NYSE:SD)

- Newell Brands Inc. (NYSE:NWL)

- Dana Inc. (NYSE:DAN)

- Welbilt Inc. (NYSE:WBT)

- Bausch Health Companies Inc. (NYSE:BHC)