Colombier Acquisition Corp. III, a blank-check firm backed by Omeed Malik, filed for an initial public offering (IPO) in the U.S. on Friday. The Palm Beach-based company aims to raise $260 million by offering 26 million shares at $10 each.

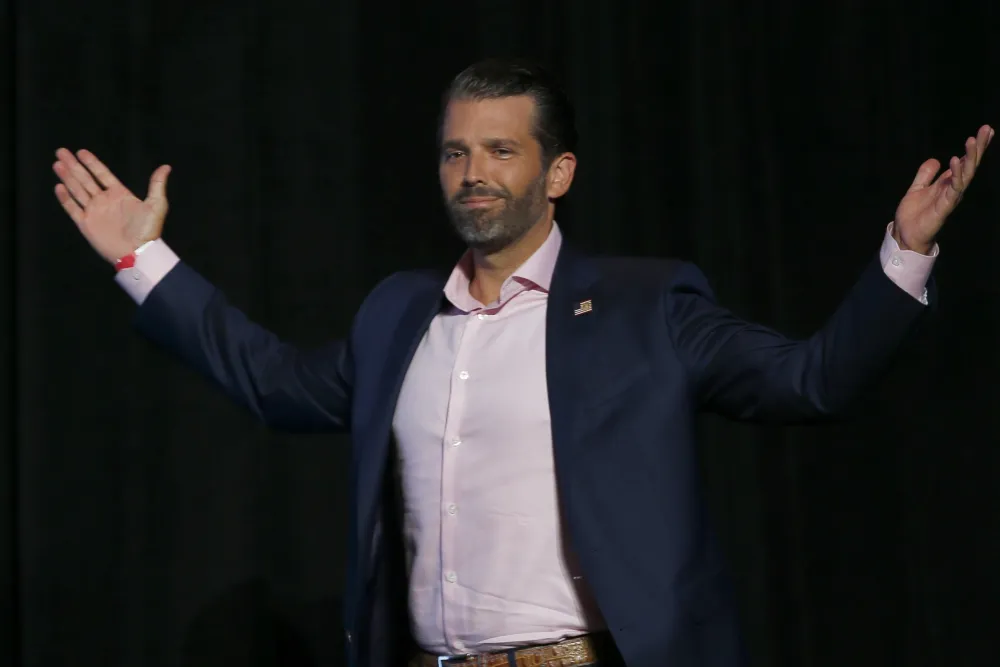

Among its directors is Donald Trump Jr., who has been a partner at investment firm 1789 Capital since November 2024. Founded by Malik and Chris Buskirk, 1789 Capital promotes itself as “funding the next chapter of American exceptionalism.” Malik, a major donor to Donald Trump’s presidential campaign, is expanding his SPAC ventures with this latest deal.

Also joining the board is Chamath Palihapitiya, known as Wall Street’s “SPAC king” for his high-profile blank-check listings. SPACs, or special purpose acquisition companies, use IPO proceeds to merge with private firms, helping them go public with less scrutiny than traditional listings.

This move follows other ventures by Trump’s family, including a meme coin launch earlier this year and World Liberty Financial, a crypto company partly owned by the president. Trump Jr.-backed GrabAGun, a firearms retailer, also went public through Malik’s Colombier Acquisition Corp. II.Colombier plans to list its units on the New York Stock Exchange under the ticker “CLBR U”, with Roth Capital serving as underwriter.