Elon Musk’s SpaceX is reportedly in talks to sell $500 million to $750 million worth of stock at a staggering valuation of $175 billion or more, making it the most valuable private space company in history, surpassing even Alibaba’s record-setting $169 billion IPO valuation in 2014. This marks a significant increase from SpaceX’s July valuation of $150 billion when investors purchased $750 million worth of stock. The potential stock sale positions SpaceX ahead of corporate giants like Disney ($170 billion market cap) and Comcast ($171 billion). The private space giant, which hasn’t revealed plans to go public, is expected to generate revenues of $9 billion in 2023, with a projected increase to $15 billion in the following year, showcasing its dominance in the space transportation market.

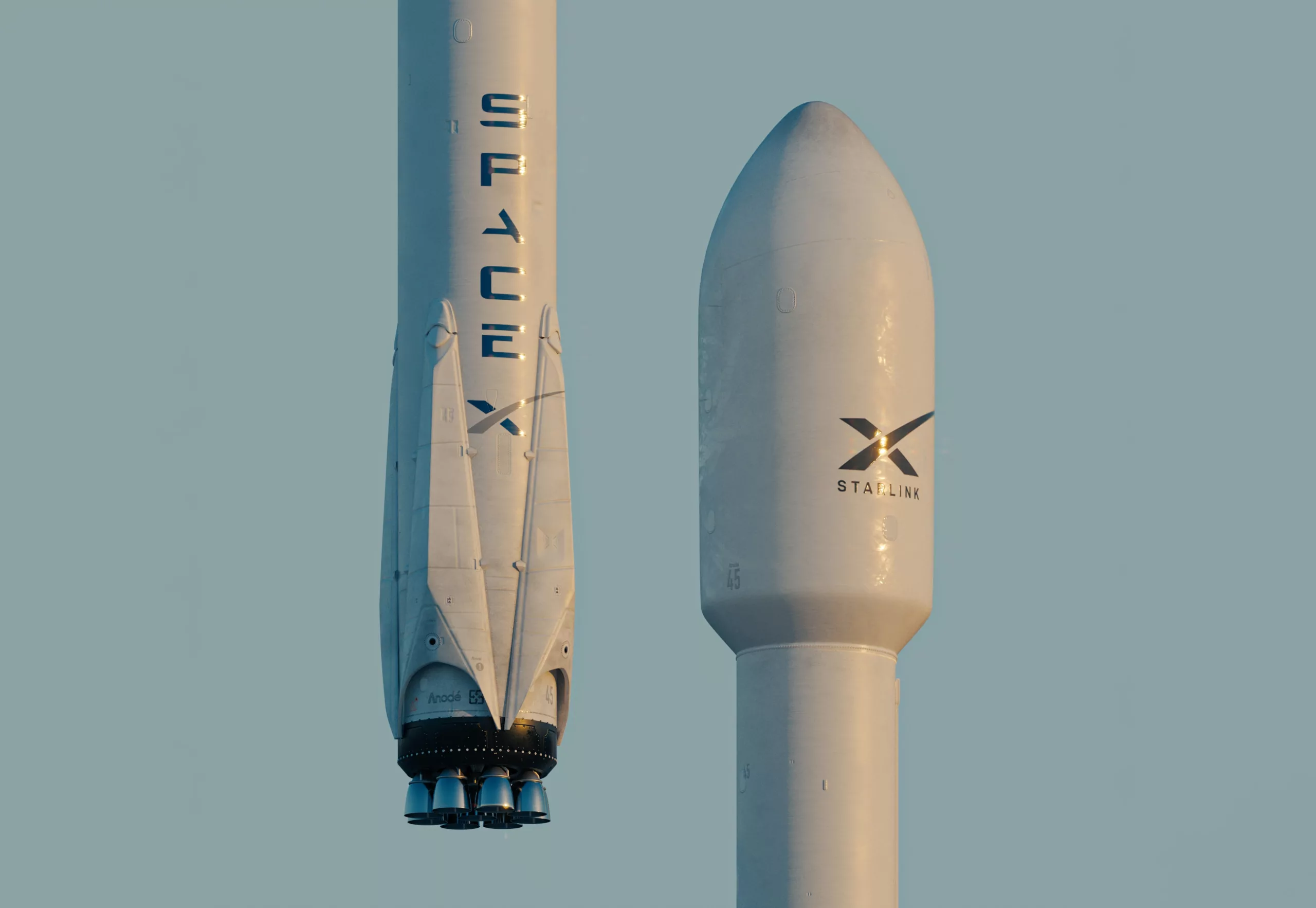

Contrastingly, another venture of Elon Musk, X (formerly Twitter), has witnessed a decline in value since going private a year ago. X employees were reportedly offered stock at a $19 billion valuation in October, with some calculations suggesting its value could be as low as $4 billion. SpaceX’s success is attributed to its prominent position in the space transportation market, executing over 64% of commercial rocket launches globally in the first half of this year. With an impressive roster of industry talent and the booming success of Starlink, SpaceX’s satellite business, which saw revenues surge from $222 million in 2021 to $1.4 billion last year, the company continues to set ambitious goals in both space transportation and satellite markets. Despite rumors of a Starlink IPO in late 2024, Musk refuted the claims, with investor Ron Baron anticipating a public offering not before 2027.