On May 11, analysts at Bank of America referred to Nvidia as the “picks and shovel leader in the AI gold rush.” Nvidia was hailed as a strong selection by Evercore analysts earlier in May.

Additionally, NVDA was recognized by Rosenblatt Securities as one of seven semiconductor stocks that stand to gain from increased investment in artificial intelligence (AI).

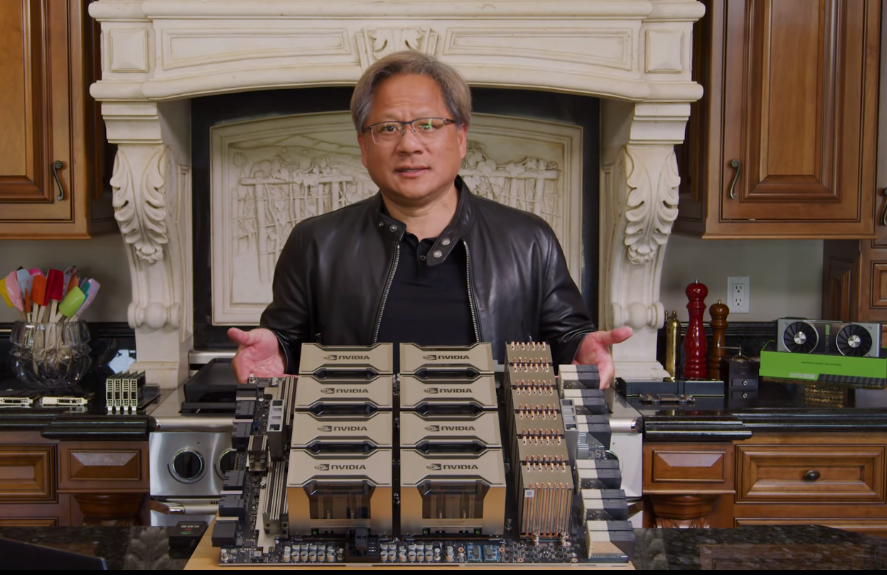

Nvidia announced a number of efforts, including collaborations and new products, in March to increase its AI footprint.

Nvidia’s data center sector, which includes AI processors, was the primary driver of its beat-and-raise report that was released in February.

The cutting-edge processors required for “generative AI” like the ChatGPT chatbot are crucial in the heated competition in the computer sector for AI domination.

From a three-weeks-tight trend, Nvidia stock topped a 281.20 purchase mark on May 1. May 17, shares increased 1.8% to 297.18, which is just outside the purchase zone, which extends to 295.26.

The 20% profit-taking target from a prior breakthrough was reached by NVDA stock in April.

Nvidia shares are trading at a year-plus high following a significant surge supported by the ongoing AI craze. They continue to be far above a rising 50-day moving average and just found support at the 21-day exponential moving average.

After collapsing in 2022, Nvidia shares have increased 103.6% so far this year.

IBD Composite Rating of 97 is awarded to NVDA. In other words, when considering both technical and fundamental measures together, Nvidia stock has outperformed 97% of all other companies in IBD’s database.

On February 22, Nvidia exceeded Wall Street’s forecast for its fiscal fourth quarter and provided a more optimistic outlook for the coming quarter.

Revenue from data centers increased 11% to $3.62 billion because to the demand for AI processors. Sales of gaming chips, meanwhile, remained dismal and dropped 46% to $1.83 billion.