Emerging-market currencies posted an eighth consecutive week of gains, despite a shaky risk-on sentiment following the U.S. Federal Reserve’s rate cut. The MSCI index tracking these currencies remained flat on Friday, with Brazil’s real and Mexico’s peso underperforming. However, the overall index capped another week of growth, while a similar gauge for emerging-market stocks rose 0.6%.

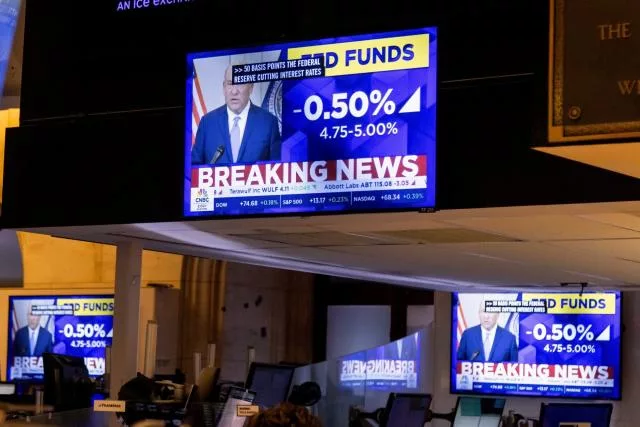

Mideast tensions and mixed comments from Federal Reserve officials added volatility to markets. Fed Governor Christopher Waller supported the recent half-point rate cut, citing favorable inflation data, while Michelle Bowman cautioned that it may have been premature to declare victory over inflation.

In Latin America, Brazil’s real fell after a six-day rally, and Mexico’s peso dipped as traders anticipated further easing from the country’s central bank. Meanwhile, Indonesia’s rupiah and China’s yuan led gains in Asia, while Thailand’s baht surged 10% since June, marking its biggest quarterly rise since the Asian financial crisis.