Shao Qifeng, Chief Investment Officer at Ying An Asset Management, has never seen such excitement in his 15-year career as he did during the last five trading sessions. Following the announcement of a major stimulus package by Chinese authorities, clients flooded Shao’s WeChat asking if it was the right time to invest. “I think we’re in the second phase of a bull market,” Shao commented, keeping his composure but celebrating internally.

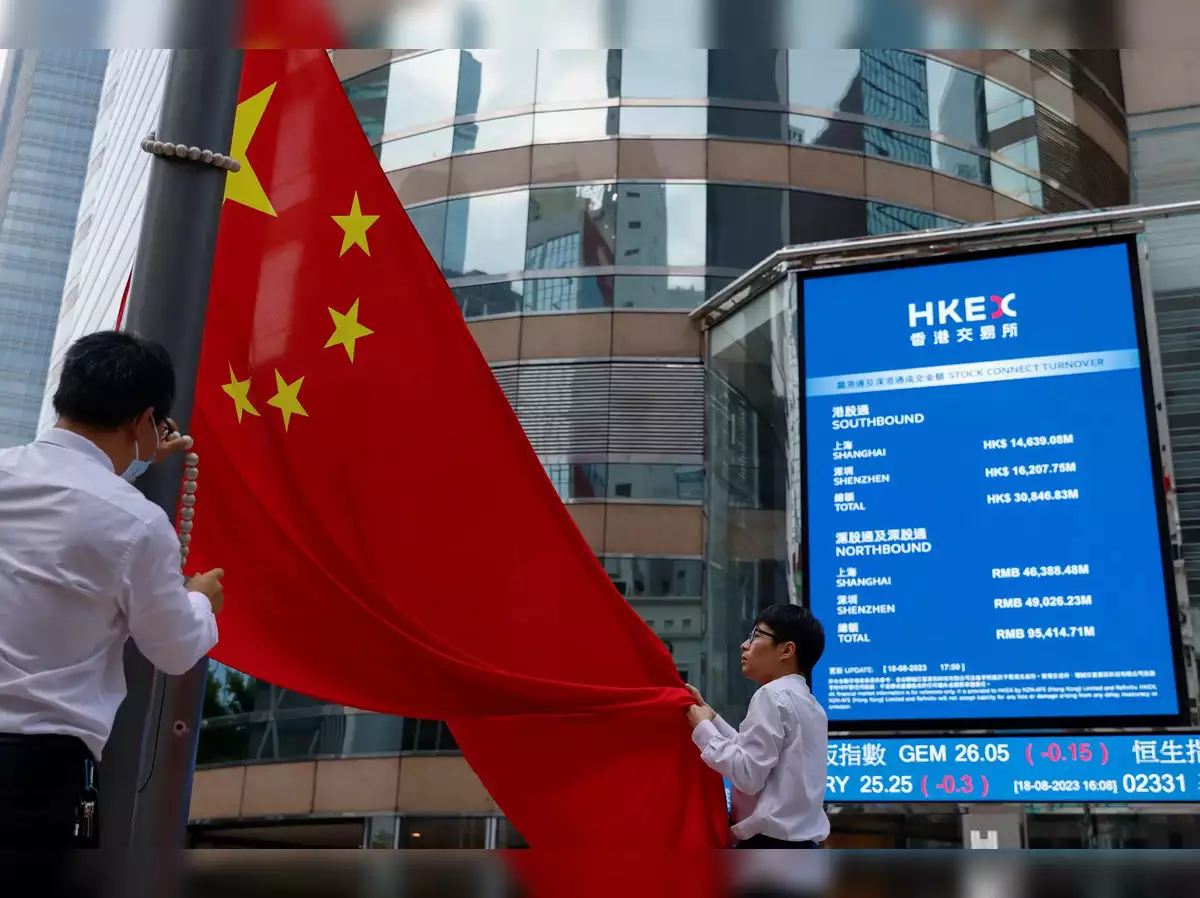

The benchmark index posted its biggest gain since 2008 on Monday, marking the start of a bull market. The stimulus package, which included relaxed homebuyer rules and mortgage rate cuts, helped boost investor confidence. The result was an unprecedented rush into the market, with trading turnover hitting record highs. In fact, brokerage applications even crashed due to the surge in interest.

Despite this optimism, Winnie Wu, Chief China Equity Strategist at BofA Securities, urged caution, noting that many investors are unsure whether to hold on or take profits after the rapid gains. Hedge funds are shifting from US tech stocks into Chinese mining and materials firms, and iron ore prices spiked 11% amid expectations of increased demand.

While enthusiasm is high, some investors remain wary of potential setbacks. “It’s too early to tell if this ‘Golden-Week rush’ will turn into a lasting gold rush,” said Hebe Chen, analyst at IG Markets Ltd.