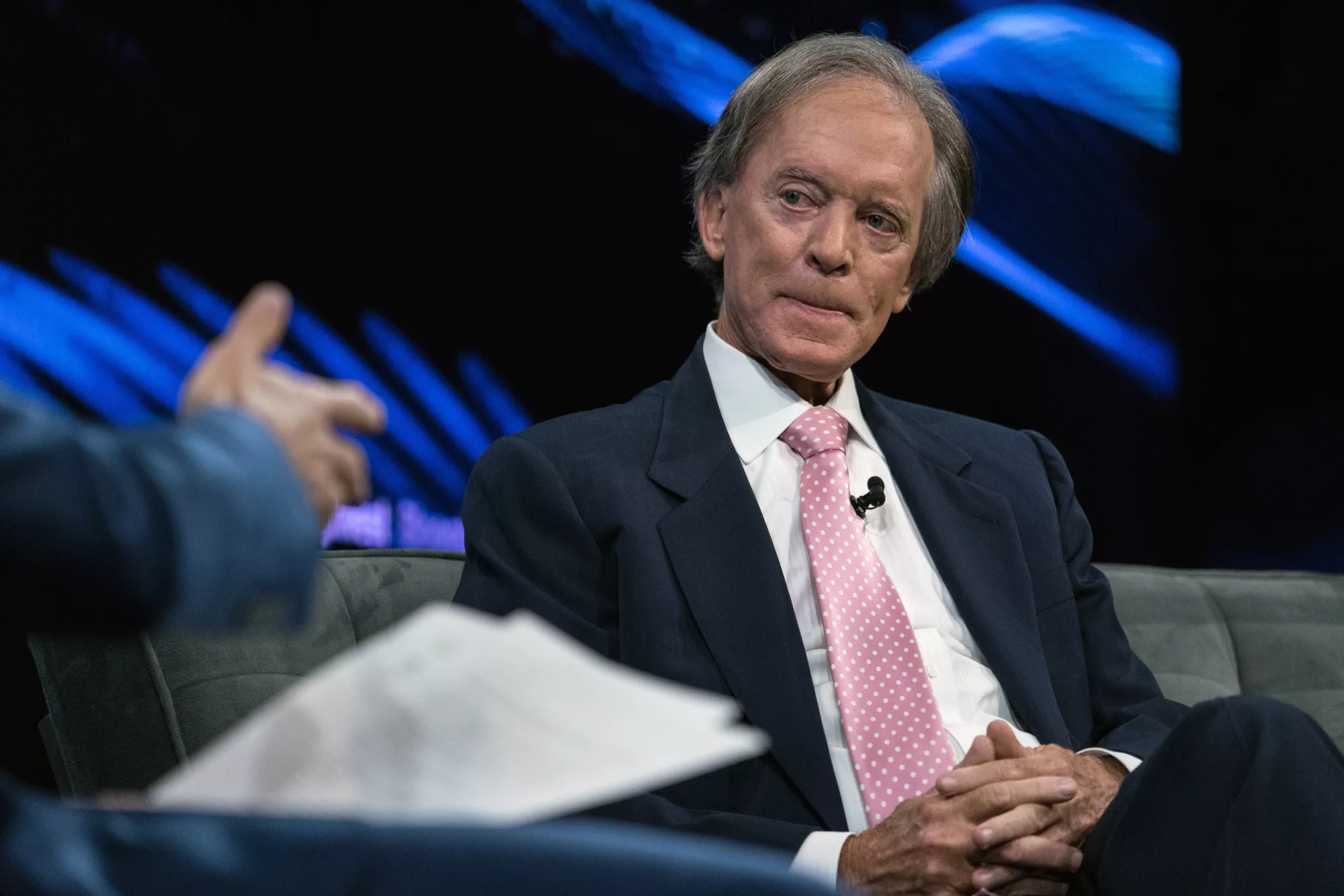

If Donald Trump returns to the White House, it would worsen budget deficits and negatively impact the bond market more than another term under Joe Biden, according to veteran bond investor Bill Gross. In an interview with the Financial Times, Gross acknowledged that Biden has also overseen significant debt increases, with deficits rising to 8.8% of GDP last year from 4.1% in 2022. However, the so-called Bond King, who co-founded PIMCO, sees more potential trouble from Trump.

“Trump is the more bearish of the candidates simply because his programs advocate continued tax cuts and more expensive things,” Gross said, adding, “Trump’s election would be more disruptive.” Trump has pledged to make his 2017 tax cuts permanent, while Biden has said he would let the cuts expire but wouldn’t increase taxes for Americans earning less than $400,000 a year. As federal deficits reach trillions, the Treasury Department has been issuing a flood of bonds, putting pressure on the bond market. Gross also advised investors to temper their expectations for stock returns, noting that high deficits and debt will continue to be major concerns for the U.S. economy.