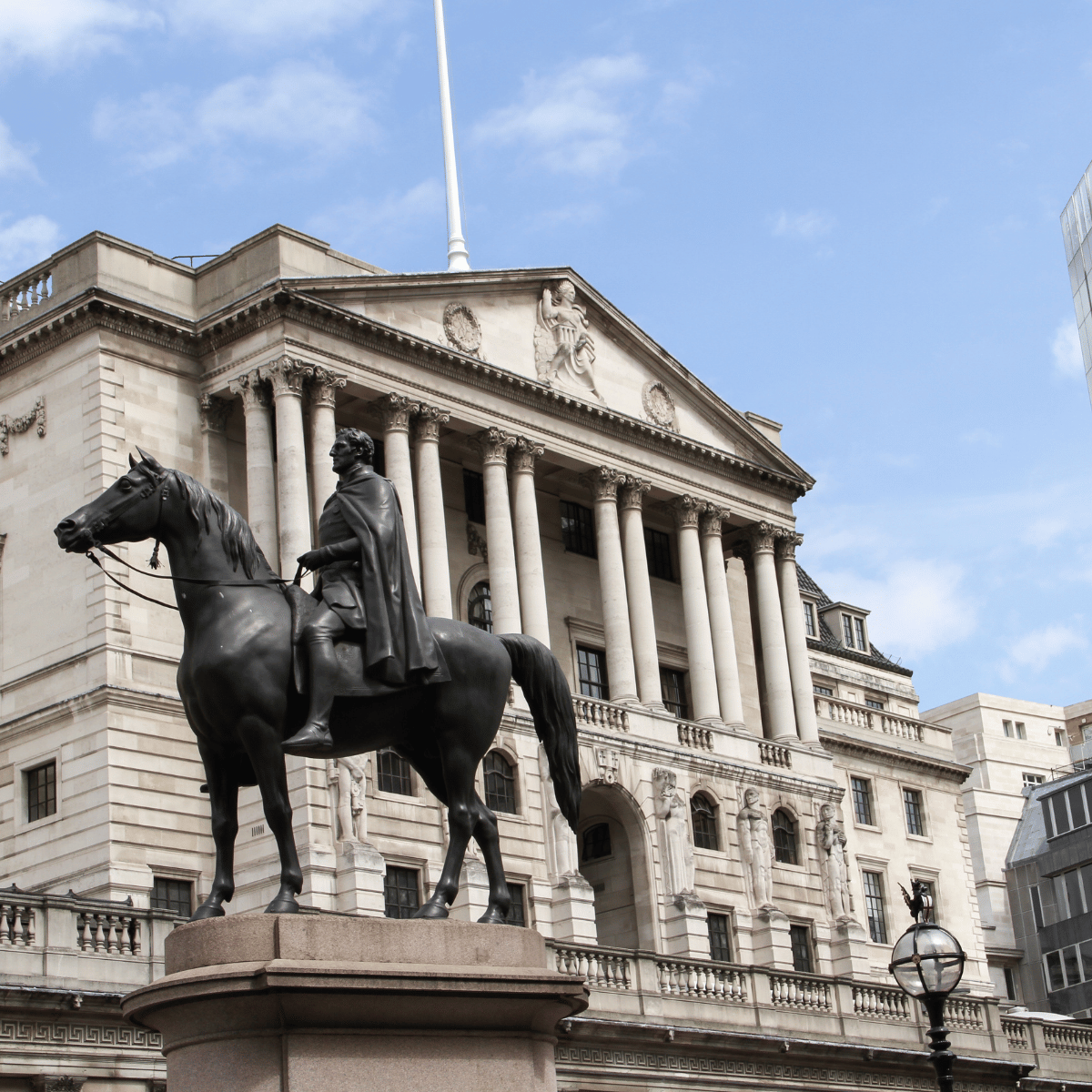

The Bank of England (BoE) is continuing its exploration of a digital currency, despite hesitations, due to concerns that commercial banks may struggle to match the pace of innovation set by tech companies, Governor Andrew Bailey shared on Saturday. Bailey, speaking at the Group of Thirty forum in Washington, reiterated his worries about payments or banking services shifting to cryptocurrencies or tech firms that may lack the security and privacy safeguards of traditional banks.

The BoE and Britain’s finance ministry have announced that a decision on a central bank digital currency (CBDC), or “digital pound,” won’t come before 2025, following a public consultation that raised privacy issues. “That (CBDC) is not my preferred option, but it’s one we can’t rule out,” Bailey remarked.

While Britain already has a robust electronic payment system, Bailey noted that future digital currencies could introduce new options, such as seamless automatic payments. However, he expressed concern that commercial banks may resist innovation due to profit gains under the current system. “If the rents that are being earned from the ‘rails’ act to inhibit innovation… that is why we need a retail CBDC on the table,” Bailey concluded.