The majority of Asian equities were up on Tuesday, despite the fact that the most recent statistics indicated that China’s economy is weaker than anticipated and that the country’s domestic demand has not recovered as much as had been anticipated in the wake of the epidemic.

Benchmarks increased in Seoul, Tokyo, and Hong Kong but decreased in Shanghai and Sydney.

A government official said on Tuesday that weaker-than-expected retail sales and other activities in April put pressure on China’s economic recovery from the epidemic.

According to official figures, retail sales increased 18.4% from a year earlier, up 7.8 percentage points from March. Other signs were conflicting: Factory production decreased 0.5% from March but increased 5.6% over the previous year. In the first four months of 2023, investment in factories, real estate, and other fixed assets increased by 4.7%, but this was 0.4 percentage points lower than the growth rate in the first quarter.

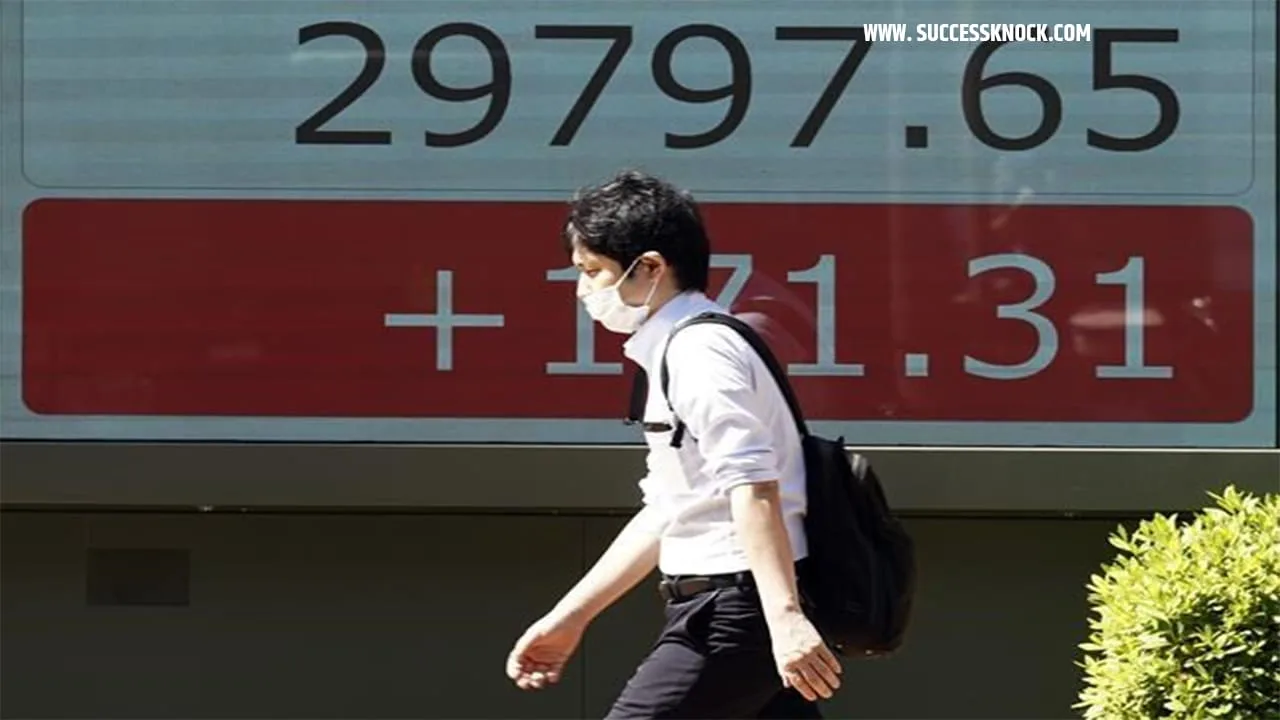

Tokyo’s Nikkei 225 index rose 0.7% to 29,842.99, extending a rise that has been aided by solid corporate results and indications that inflationary pressures may be abating toward its highest level since the early 1990s.

The Shanghai Composite index shed 0.5% to 3,292.99, while the Hong Kong Hang Seng dipped 0.2% to 19,945.86.

The S&P/ASX 200 in Australia fell 0.4% to 7,240.90, while the Kospi in Seoul slipped down 0.1% to 2,477.14.

The S&P 500 increased by 0.3% to 4,136.28 on Monday, and the Dow Jones Industrial Average increased by 0.1% to 33,348.60. To 12,365.21, the Nasdaq composite increased by 0.7%.

However, the market remained comparatively calm as multiple worries dampened optimism.

From 136.12 Japanese yen, the dollar dropped to 136.01 yen. From $1.0875 to $1.0881, the euro increased.