Apple reported stronger-than-expected earnings, thanks to solid iPhone sales, but shares dropped 4% on Friday as investors worried about the long-term impact of Trump-era tariffs.

🔹 Key Numbers:

- Q2 Revenue: $95.4 billion

- Tariff Impact: $900 million hit expected in Q3

- Services Revenue: $26.6 billion

- Shares fell 4% after earnings call

🔹 What’s the Problem?

- Despite exemptions on phones and computers, Trump’s 145% tariffs on Chinese imports are forcing Apple to shift iPhone production to India

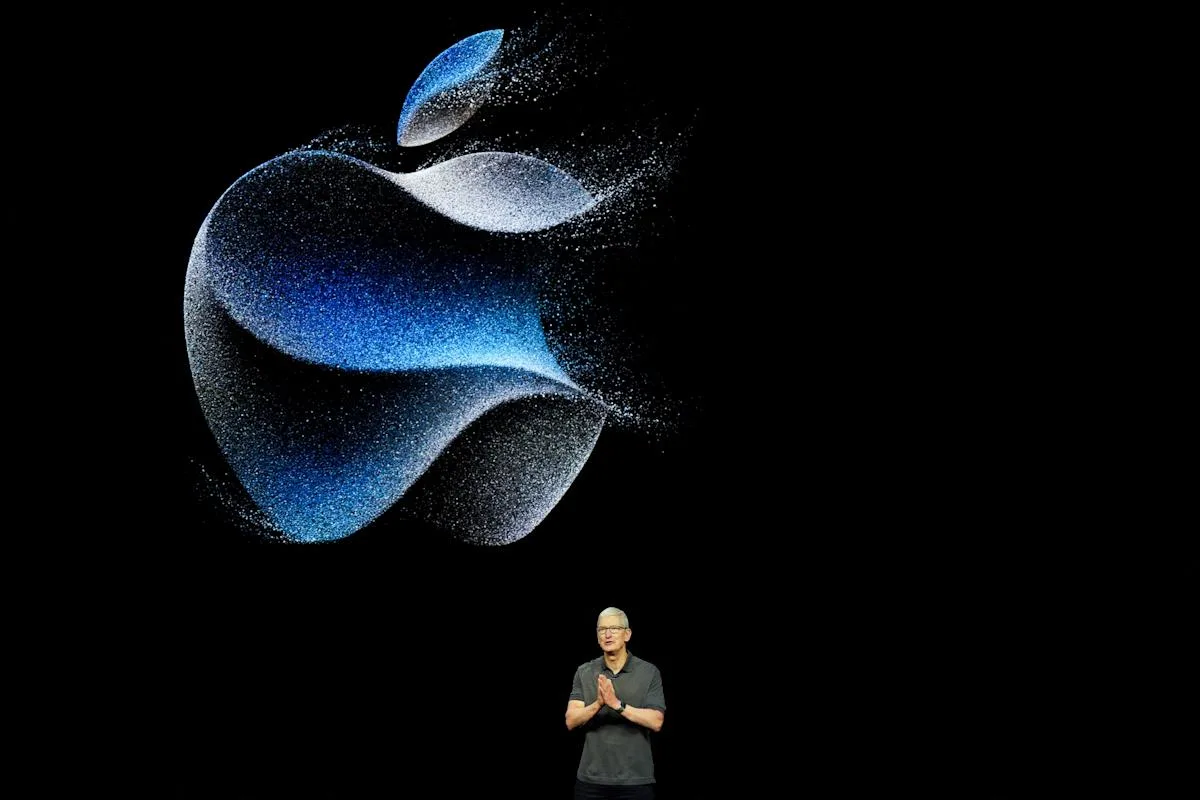

- Apple CEO Tim Cook said it’s too early to provide future guidance and declined to predict the long-term impact

🔹 Why Apple Is More Exposed:

- Unlike other tech giants, Apple depends heavily on overseas manufacturing

- It’s trying to move production to India and Vietnam, but those countries face tariff uncertainty too

🔹 Analyst Reactions:

“This is the best-case scenario… and it’s still risky,” said Jefferies’ Edison Lee

UBS warns iPhone revenue may decline year-over-year in June

🔹 What’s Next?

- Tariffs on India and Vietnam are paused — for now

- The Trump administration’s Section 232 review on semiconductor tariffs could deal another blow to Apple if duties are imposed

Until trade policy becomes clearer, Apple’s future remains uncertain.