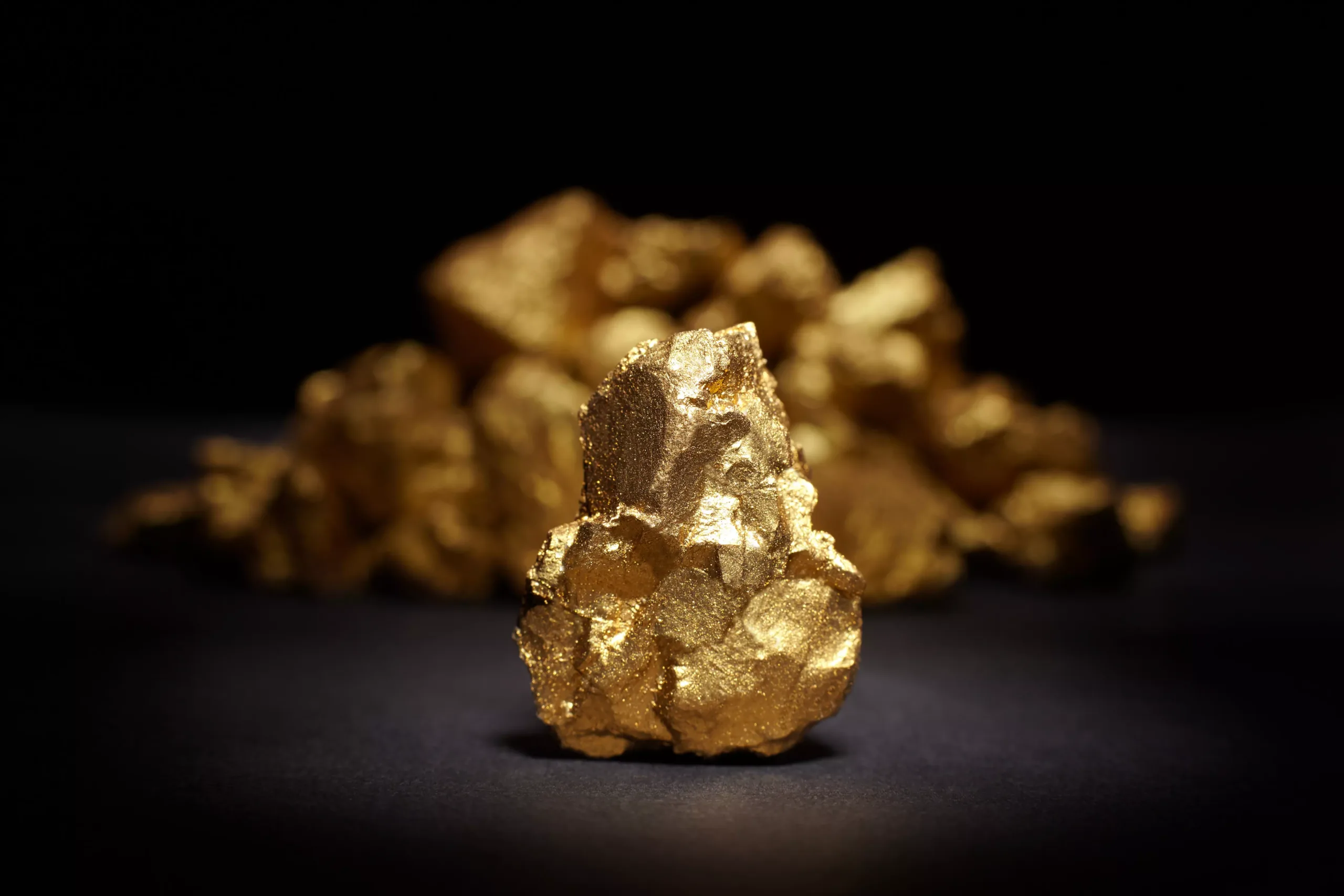

Americans who once hoarded gold bars and coins are now cashing in, while Asian investors continue snapping up bullion, highlighting contrasting views on the global economy. The split shows US retail investors — who buy physical gold like day traders — feel more confident about President Trump’s tariffs, government debt, and geopolitical tensions, seizing profits after gold’s surge over the past two years.

In contrast, Asian buyers are ramping up purchases of bars and coins instead of jewelry, underscoring persistent demand for gold as a safe haven. The trend diverges from wealthier US investors and sovereign funds, which are still adding gold to their portfolios alongside central banks stocking up on the metal.

This east-west divide suggests Americans see less need for protection, while Asians remain wary of economic uncertainties.