Advanced Micro Devices (AMD) posted higher-than-expected sales and profitability for the first quarter, but the stock fell 6% in extended trading on Tuesday when the chipmaker offered forecast for the current period that fell short of analysts’ expectations.

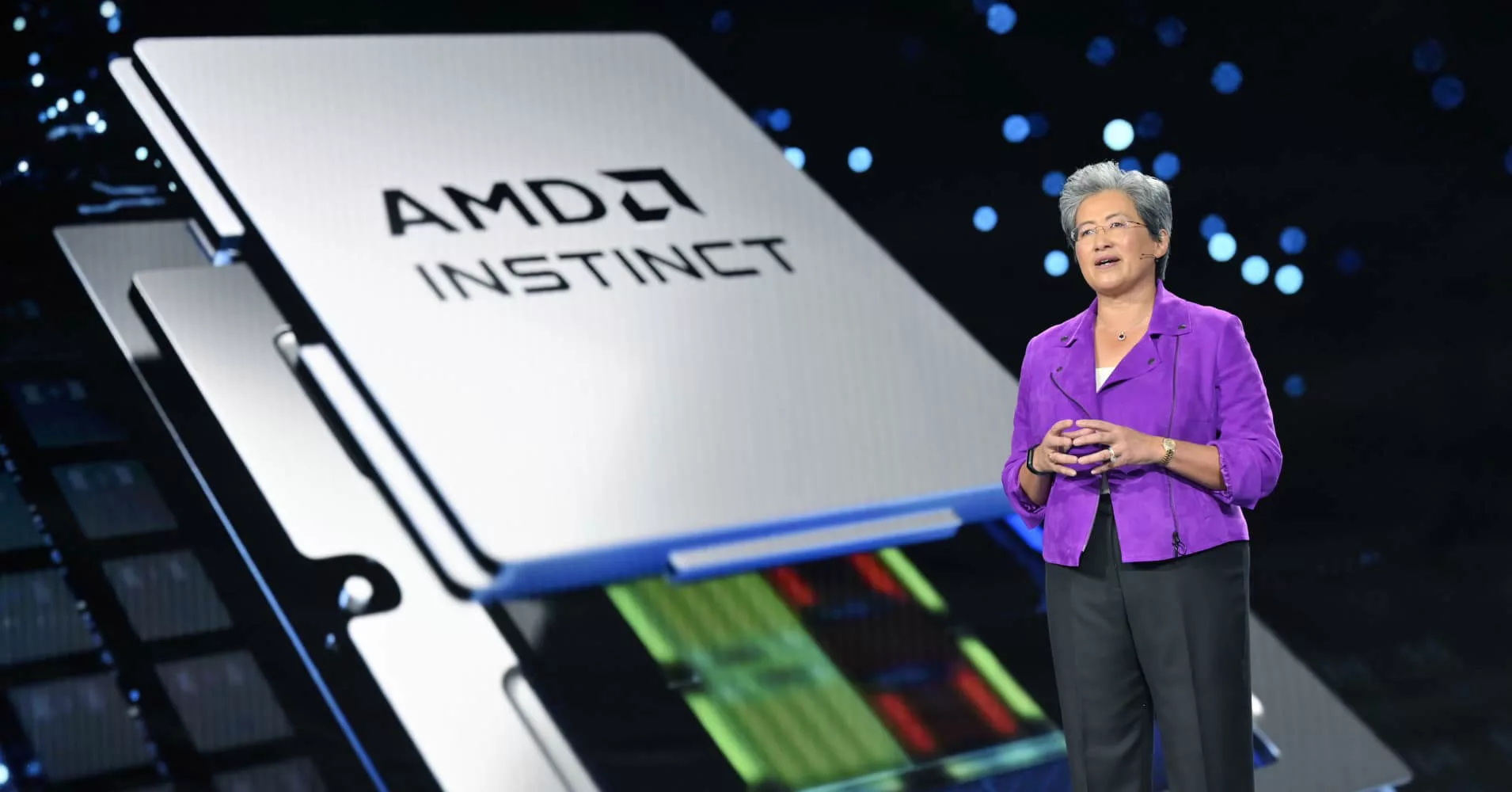

In comparison to Wall Street predictions of $5.48 billion in sales for the current quarter, AMD said it anticipated sales of roughly $5.3 billion. According to a statement from AMD CEO Lisa Su, the firm expects “growth in the second half of the year as the PC and server markets strengthen.”

From a net income of $786 million, or 56 cents per share, during the same time last year, the company’s net loss changed to $139 million, or 9 cents per share. AMD deducts some investment losses and acquisition-related expenses from its profits.

Revenue decreased by 9% from $5.89 billion in the prior year.

The segment of AMD’s clientele, which includes sales of PC chips, had the highest fall. AMD reported sales in the category of $739 million, a 65% drop from $2.1 billion in sales during the same time period in 2017.

The release of AMD’s study coincides with a severe downturn in the PC market, with first-quarter shipments falling 30%, according to IDC. Intel, AMD’s main rival in the PC and server chip sectors, reported a 36% fall in total sales last week.

Su stated, “We think the first quarter was the low point for our client processor business.

The revenues for AMD’s data center sector increased somewhat from the same period last year ($1.293 billion) to this year ($1.295 billion). The business predicted that the category will probably increase in the current quarter.

Sales of less powerful networking chips in its embedded division increased to $1.56 billion from $595 million year over year, in part because the company’s acquisition of Xilinx brought in more money.

Sales for AMD’s gaming division, which includes chips for consoles like the Sony PlayStation 5 and graphics processors for PCs, came in at $1.76 billion, a decrease from $1.88 billion in 2017.