Swiss engineering giant ABB announced Wednesday the launch of three new families of factory robots — Lite+, PoWa, and IRB1200 — specifically developed for China, as the company seeks to tap into surging automation demand among the country’s mid-sized manufacturers.

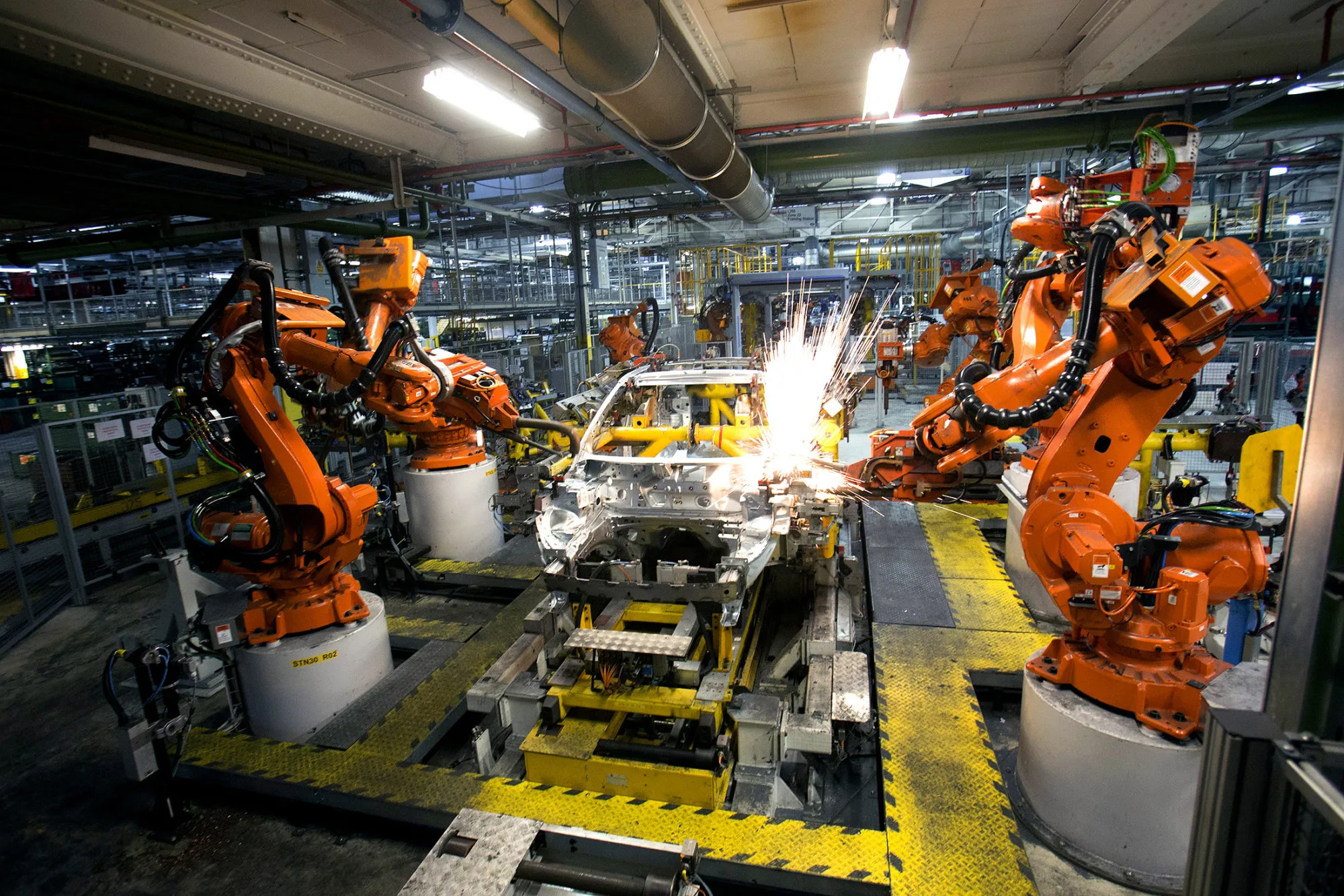

The new robots are designed for sectors like electronics, food and beverage, and metals, performing tasks such as polishing, product placement, and basic pick-and-place operations, ABB said in a statement from Zurich.

China’s mid-market robotics segment — where robots handle simpler jobs like packaging or inspections — is expected to grow 8% annually over the next three years, outpacing the recent global industry average, ABB highlighted. This growth is fueled by ongoing labor shortages and increasing accessibility of automation technologies.

“With artificial intelligence, the robots are easier to use and therefore more appealing to customers who did not have them in the past,” said Sami Atiya, president of ABB’s Robotics & Discrete Automation business.

Key features of the new robots include:

✅ Speedy deployment: One model can be operational within just 60 minutes of unpacking.

✅ Intuitive programming: Robots can learn tasks by observing or by responding to voice commands.

✅ Flexible performance: Robots offer varied load capacities and speeds to match specific production needs.

✅ Accessible pricing: Units will range from $20,000 to over $100,000, ABB added.

The robots will be manufactured at ABB’s new state-of-the-art factory in Shanghai, reinforcing ABB’s commitment to the world’s largest robotics market. In 2023, China installed 51% of new robots worldwide, according to the International Federation of Robotics (IFR). The country currently accounts for around 30% of ABB’s total robots business.

Atiya downplayed concerns over potential impacts from U.S. tariffs on China, citing the strength of China’s domestic market and persistent labor shortages.

Earlier this year, ABB announced plans to spin off its robotics division, which competes with Japan’s FANUC, Yaskawa, and Germany’s Kuka. Atiya confirmed the spin-off remains on track for completion by Q2 2026, but declined to comment on its valuation or interest from potential buyers.

“We have to entertain anyone who is interested in a sale, but clearly our target is the spin-off,” Atiya said.